Merger & Acquisition Similarities to Plastic Collisions

Abstract

Presently I am researching Mergers & Acquisitions looking for similarities and analogies to physical phenomena. Although analogies in the form of DNA base complementarities have been proposed we have not seen any analogies with the physical world. If one substitutes the term mergers with the term collisions an analogy becomes evident. A review of 30 major M & A projects of the last 15 years combined with current and past research indicates an easily identifiable pattern between them resembling plastic collisions in nature.

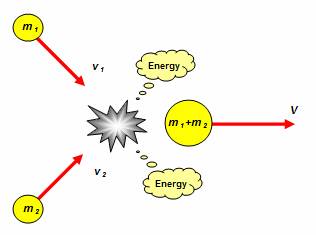

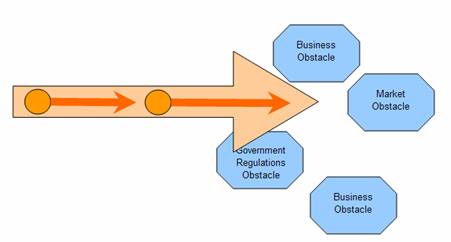

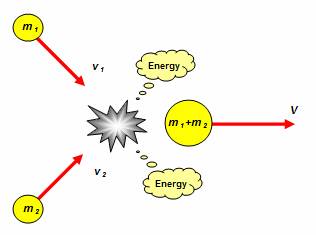

Figure 1: Collision in the physical world of masses m1 and m2 with velocities v1 and v2

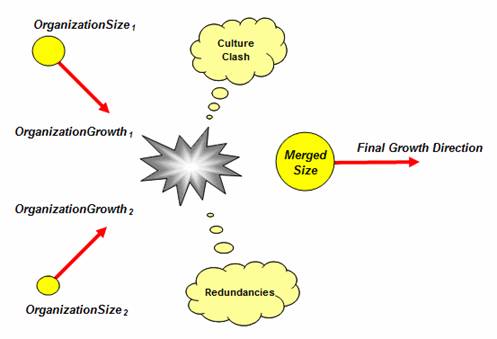

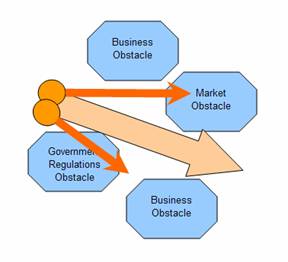

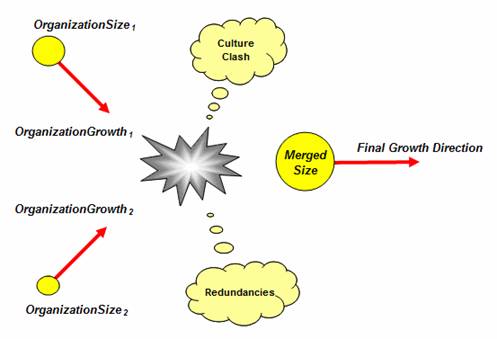

Figure 2: Collision in the world of M&As

Characteristics of the physical phenomenon involve the creation of a new object that by analogy corresponds to the merged organization, the release of energy that by analogy corresponds to the losses during the integration process, and a velocity vector that correspond to the direction and magnitude of growth of the business. The simplistic analogy is further analyzed with the breakdown of each organization in its constituent entities that among others include management, manufacturing and production, distribution channels, sales and marketing, human resources, information systems and organization culture. Success and failure of a M&A can be attributed to misalignment of the corresponding entities that during the collision process can easily contribute positively or negatively on the final outcome.

Introduction

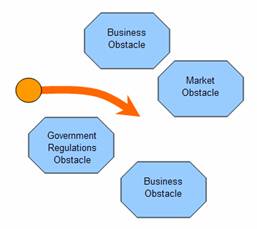

Business organizations operate in a more than ever changing environment where adaptability and evolution is the primary ingredients for survival and growth. The market landscape where businesses operate nowadays could easily resemble the conformational landscape that objects experience as they interact in the physical world. As masses in motion go uphill, downhill and around physical obstacles, business organizations have to operate in today s raff business terrain formed by hills (mountains in some cases) and valleys (opportunities) of the economy space were businesses operate.

Energy is required to overcome hills or move around them and increase our momentum to move (grow) faster (in our case to grow faster). To overcome obstacles, supplement to internal efforts aimed towards growth diversification or profitability, businesses join forces or develop strategies of exploring the conformation space near them and grow by following the most suitable path.

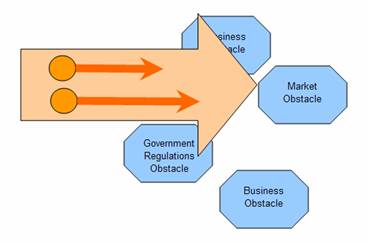

Businesses integrate horizontally to remove obstacles created by competitors and gain a wider coverage of the conformation space. M & As can extend a company s product line or global reach. Scale affords the ability to attack emerging opportunities head-on, at a very high level. When British Petroleum merged with Amoco in 1998 their market reach widened beyond the simple accumulation of their perspective coverage areas. Due to their size they could afford to operate in politically unstable environment. Similarly when Pfizer merged with Warner-Lamber they further enhanced the globalization of the company by allowing them to leverage the significant presence that they each had internationally, whether it was with Europe, Japan or elsewhere.

Global reach was also one of the motivating factors behind the merger of Chrysler and Mercedes. Their joint venture would have allowed them to penetrate China, India, and underdeveloped nations in Africa and South America with new car designs. Economies of scale in R &D and in procurement were also very prominent features of auto manufacturing. Car manufacturers at the time were also planning to use the Internet for B2B for e-procurement in order to reduce their supplier costs and increase response speed.

Similarly Pfizer merged with Warner-Lamber to further enhance the globalization of the company, by allowing them to leverage the significant presence that each had internationally, whether it be with Japan, Europe and elsewhere. The merger provided scale in research, as well as in the marketing and sales functions Businesses can integrate vertically to gain momentum and overcome obstacles in the direction they grow.

The oil industry provides some of the best examples of vertically integrated companies such as ExxonMobil, Royal Dutch Shell, or BP since they are active all the way along the supply chain from locating crude oil deposits, drilling, extracting, transporting,

Businesses also form conglomerates to gain enough maneuverability to move around and through the obstacles. The media industry provides some well know conglomerates like AOL and Time Warner when they merged in an effort to create synergies between them. Their diverse portfolio of assets was supposed to allow them cross-promotions and economies of scale in order to allow each of company to get a piece of the Internet future that they could not themselves provide.

To understand social phenomena and successfully handle their complexities we often seek analogies that will simplify the analysis and enhance our perspective.

The most natural analogies would relate to our everyday experience in the natural world we function. Researchers [ ref ] have already wondered if there is anything similar to mergers and acquisitions in the natural world. Although analogies in the form of DNA base complementarities have been proposed we have not seen any actual merger analogies while it is evident in the evolution of life as we know it that mergers did occur and in fact our own cells are the result of this kind of merger (or acquisition in some sense). As most of us learned in our high-school biology classes the human cell is a merger of two entities our primordial human cell and that of mitochondria (a remnant of bacteria cells). Although there are many other such examples it would be unlikely to adopt such similarity for modeling purposes since the time scale of social evolution is magnitudes smaller in time (faster in terms of speed) to our biological evolution. But something we haven t really noticed at all are the mergers we observe in the physical world. If one substitutes the term mergers with the term collisions the analogy would be evident. It would be unlikely and probably macabre for somebody to call crashing his car with another car a merger of cars but it is extremely tempting to see how nature performs this process since the beginning of time and establish some analogies in M&As.

In classical mechanics we have plastic collisions where two bodies merge and move as one after the collision while and energy in the form of heat is released to the environment. If we were to replace now the masses with the organization s size and the velocities with the direction and size of growth we could easily see the proposed analogy between the physical and social phenomenon. In M&As the energy released is in the form of the acquirer closing down less competitive facilities, eliminating the less effective managers, and rationalizing administrative processes.

In the business world when two organizations merge internal structures (at least of the target organization) are readjusted to fit the structure of the acquiring company. This takes time and energy. Bringing the law of physics to the social phenomena world we can state the principle that energy will be always lost in a M&A situation. At least until the acquiring organization assimilates the target organization as its own organic growth.

The challenge for businesses is to eliminate losses as they move toward merger completion by melding the merging organizations into one that can keep growing end evolving without missing a beat. To do that one has to look deeper into the constituent elements of each organization and examine the effort and energy required for their alignment. The energy associated with plastic collisions in nature is released in the form of heat in the environment and is converted to mechanical energy for the redistribution of the various elements (masses) that form the unified object.

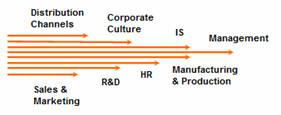

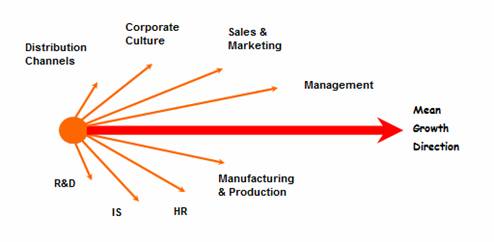

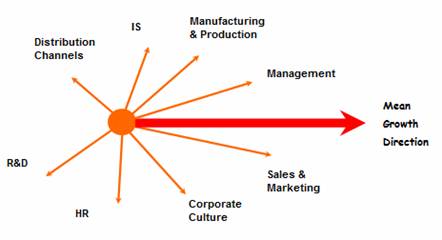

While though nature isn t really interested in preserving the internal structures of the colliding masses in the case of mergers and acquisitions we can not afford to drastically rearrange and modify organizational structure. Preserving the analogy with the physical world we view organizational growth as the resultant vector of the constituent vectors like sales and marketing, manufacturing and production, information systems, and corporate culture among others. In an ideal organization all these vectors will be perfectly aligned to produce maximum growth.

Since reality most of the times is far from ideal it is more natural to have distributions with variable orientations of the constituent vectors.

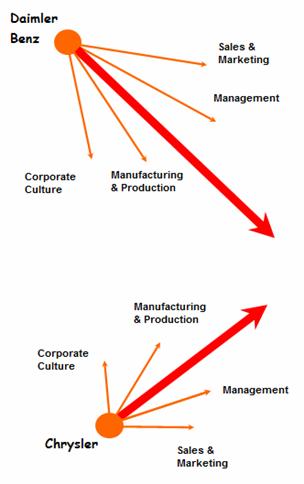

Cultures can range from freewheeling to bureaucratic, human resources can have different compensation and incentive systems and information systems can be based on different technologies to name a few. Having such a microscopic view of merging organizations it is obvious why a simple addition of the resultant vectors will not represent the addition of the individual component vectors. There are numerous cases where the almost opposite directions of certain vectors brought the mergers to its knees. When Daimler acquired Chrysler the cultural conflicts between the two companies were particular damaging. The two were having different marketing strategies, management styles, processes and work styles with technically impossible to combine platforms: Mercedes-Benz models were rear-wheel drive while most Crysler models where front-wheel drive. The figure bellow depicts the situation where the two cultures are on a head-on collision. This is a situation where the stronger culture will dominate but in the process will reduce the overall growth of the combined business.

We can easily see that while both mean growth arrows point in the same direction internally they exhibit different distributions of their constituent arrows. Obviously if we superimpose the two pictures (in an effort to increase the overall direction of grown by adding the mean growth directions) we would have to face the misalignment in the directions of the internal vectors. Aligning the internal vectors would require energy and time that immediately translates in money.

A major factor that will affect the integration endeavor is the size or merging organizations. Large companies like HP and Compaq had deeply entrenched processes and values that made difficult to integrate their two cultures. The Citicorp-Travelers merger of 1998 is another example of post-merger difficulties. The merger suffered severe culture clashes and endured a nasty power struggle at the top when Citicorp's John Reed departed. When Newell acquired Rubbermaid the two companies had different production processes and cost structures; they used different value propositions to appeal to customers. They both sold household basics to the same pool of customers, but they had fundamentally different basis of competition. Newell competed primarily by efficiently churning out prosaic goods that could be sold at cut-rate prices. Low cost producer. Newell also had some strong brands but as a manufacturer, its cost position is what tends to seal its fate. Rubbermaid on the other hand was a classic brand company. Even though its products were low-tech, they sold at premium prices because they were distinctive and innovative. Rubbermaid could afford to pay less attention to operating efficiency. Its earnings capacity was primarily tied to its brand power. Both companies sold household products through essentially the same channels; therefore they had very complementary skills. Newell could operate Rubbermaid - a great branded marketer with traditionally high-margin products - as a stand-alone division, maintaining its positive characteristics while fixing a number of known weaknesses in Rubbermaid s supply-chain management. Rubbermaid would help Newell expand its geographic scope, providing a launch pad for overseas expansion. In their case while we can obviously see alignment of sales and distribution channels (since both companies sold household products) we see misalignments in their business models with differences in their cost structure, marketing and sales strategy, operations and production. Although both companies sold a lot of household basics to the same customers, the two companies had fundamentally different bases of competition. Rubbermaid competed on the basis of brand strength, whereas Newell competed on the basis of low-cost production. Their production processes and costs were different; their value propositions were different. They were actually in very different businesses, and Rubbermaid's strategy simply wasn't going to work in the markets Newell relied upon. In addition the implied cultural differences and the volatile market environment doomed the possibility of success for the merger.

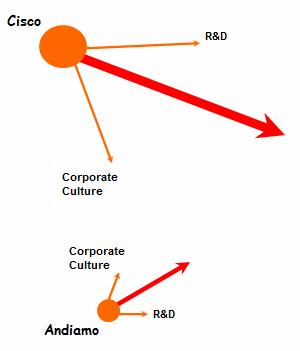

Acquiring smaller businesses seems to be more beneficial. When Cisco acquires smaller firms it is primarily interested in the new technology they will bring with them. Even though opposite constituent vectors might exist the energy released from the clash is much smaller than the benefits gained by the alignment (complimentarily in a sense) of the R&D constituent vectors.

Merging for the benefit of enhancing some of the constituent vectors is a very common strategy to sustainable growth and enhancing the competitive advantage of the acquiring business. Kellog had this rational in mind when it acquired Keebler. Kellog was interested in the direct-store-delivery (DSD) system that Keebler developed and their SAP technology platform. Alignment though doesn t always work as it is initially planed. AOL and Time-Warner where hopping to benefit from each others distribution. Time-Warner was going to use AOL position and customer base to penetrate the Internet while AOL was going to sell subscriptions to Time Warner media. Unfortunately this was overestimated and along with the organizational differences between the two partners brought the merger to end. Citicorp faced similar difficulties when merged with Travelers Insurance. While the merger was based on cross-selling opportunities they were far too optimistic about the timetable for realizing them. In addition there were broad cultural differences between the low-cost, US-focused Travelers group and the global, disparate, conservative, and internationally minded Citibank.

Conclusions

By definition the option to merge in most cases is based on the fact that the majority of the internal arrows will point in directions close to the mean growth direction of the organization. So, in general it s a good principal to consider M&As when the mean growth direction is similar in both organizations. That might be an initial indicator for a potential M&A. The next step would be to get a clear picture of the internal structure of both organizations in order to be able to identify misalignments that could be problematic. If the internal distribution is different in the two organizations strategies need to be developed to handle the situation. Organizations can develop strategies for successfully merging and acquiring other organizations by understanding the actual picture and selecting strategies to align their internal structures as smoothly as possible.

What is evident from the perspective of looking M&As as collisions is that companies need to strategically prioritize when planning a merger or acquisition. Separate strategies need to be developed by the conversion team for the constituent parts (vectors) of the business. The proposed view leaves plenty of conventional wisdom intact. Aligning vectors doesn t mean picking one over another. Frequently, cuts are unavoidable. But the process of successfully merging two divergent corporate cultures into one is often an exercise in carefully crafting a third way a wholly new culture befitting a new company. It can tap the best practices of the two merged organizations and consciously involve both sides from the very beginning.

Presentations

Harkiolakis, N., Mergers &Acquisitions - Analogies to Collisions of Physical Objects", 3rd International Nonlinear Sciences Conference (INSC2008), Chuo University, Tokyo, Japan, March 13-15, 2008